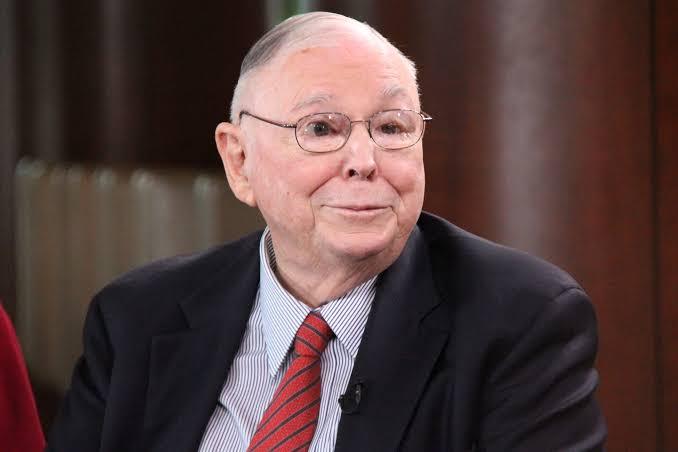

Investment Principles by Charlie Munger

Charlie Munger, an eminent investor in his own right, expressed several Buffettesque investment principles.

1. Specialization in the business world often produces very good business economics.

2. The advantages of scale are important. When Jack Welch says he will be number one or two in a business or out, he is not crazy, just tough. Too many incompetent CEOs do not understand this. But bigger is not better if it creates bureaucracy, e.g., the federal government or AT&T

3. Technology can either help you or kill you. The difference is whether the customer gets all the savings or if some of the savings go to the shareholders.

4 . Investors should figure out where they have an edge and stay there. Stay in your circle of competence. Remember the John Train question: “How do you beat Bobby Fischer?” Reply: “Get him to play you any game except chess.”

5. Winners bet big when they have the odds otherwise, never. Those who make a few well-calculated bets have a much greater chance. Very few investors or investment funds operate this way. So, load up on a good idea; it is hard to find a good business at a great discount.

6. A significant discount means more upside and a greater margin of safety. Buy shares of a good business at a significant discount to a private buyer’s pay.

7. Buy quality businesses even if you have to pay up. Warren Buffett claims this is the most important thing he ever learned from Charlie Munger.

8. Low turnover reduces taxes and increases your return. Two investors earn the same compound annual return of 15 percent for thirty years. If the first pays a 35 percent tax at the end of the thirty years and the second pays a 35 percent tax each year, the first investor will have two and a half times as much money as the second.